European Fuels Industry: on track to meet current SAF mandate and exceed 2030 targets

We reject claims from the aviation sector suggesting a lack of Sustainable Aviation Fuel (SAF) supply. Our members are on track to meet their current mandate and exceed 2030 targets. Despite policy and investment challenges, European fuel producers have rapidly scaled SAF output and lowered costs. We urge regulatory clarity, feedstock support, and fair recognition of ongoing efforts, and underline our commitment to decarbonising aviation and achieving EU climate goals.

With surprise and concern, FuelsEurope and its members are following the public debate that recently emerged around the availability of Sustainable Aviation Fuels (SAF) in the EU and the role of the European fuel manufacturing industry.

Recent statements from the aviation sector claim that fuel producers are failing to deliver the required quantities of SAF to the market, based on a first version of a 2025 Boston Consulting Group (BCG) report. The very same report, however, omits any reference to the European fuel and refining industry, which is already supplying SAF to the EU market and supporting the achievement of the European targets set by the ReFuelEU Aviation initiative. Following the public use of this study by the aviation sectors and the possible misinterpretation of its conclusions, it is to be noted that BCG has clarified that global “supplies of bio-SAF are projected to reach 9 to 12 million tons by 2030 and exceed the regulatory-driven demand (including ReFuelEU mandates of about 3 million tons in 2030)”1.

The current capacity of HEFA (today the most common bio-SAF) operated by FuelsEurope’s members in the EU is about 1.5 million tonnes per year. An additional 2,4 million tonnes per year additional firm SAF capacity set to come in operation up to 2029. In comparison, the SAF needed to cover the 2% ReFuel EU mandate in 2025 is 1 mln tn/yr (already produced). The SAF needed to cover 6% mandate in 2030 is 2,7 mln tn/yr, and is expected to be met.

The European Union’s own Aviation Safety Agency (EASA)2 comes to similar conclusions: SAF supply is expected to exceed 3.2 million tonnes annually by 2030, supported by a growing number of projects across the EU.

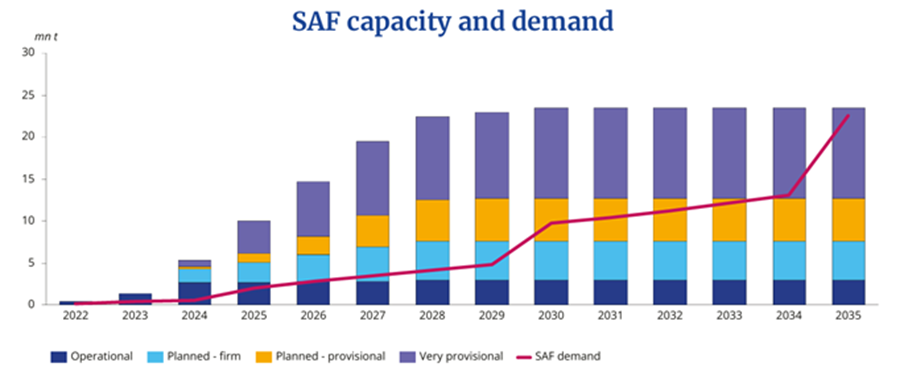

Moreover, according to Argus Media, the EU SAF capacity is expected to exceed demand until at least 2035:

Argus Media - Spotlight on European SAF Market - Countdown to 2025

This trajectory signals clear progress toward decarbonising the aviation sector. Despite operating in an unstable environment, with a fragmented legislative framework that does not offer a clear business case for the billion-euro investments required to transform refineries into renewable fuel production hubs, our members continue to invest—assuming significant risk—in a market with high production costs that lacks the needed support.

Currently, seven biorefineries (with another one under transformation), are already producing 100% renewable fuels for all transport modes, for a total volume of about 4 million tonnes per year supplied to the EU market. At the same time, other refineries are moving towards co-processing fuels from a mix of fossil and sustainable feedstocks. SAF is a high-priority in these conversions that are all dedicated to meeting the goals of the Fit-for-55 package.

These pioneering and innovative actions by the European refining sector have led to:

• A significant ten-times increase in SAF production within just two years (from 100Kt in 2022 to 1Mt in 2024);

• A significant and consistent decline of average SAF prices, with the premium falling from a ratio of over 4 to below 2 compared to conventional jet fuel levels within just three years.3

We share concerns over the affordability of SAF, so policy needs to enable the mobilisation of more feedstocks for SAF and provide targeted support for highly capital-intensive e-SAF projects in the forthcoming Sustainable Transport Investment Plan.

An adequate legislative framework and a clear business case for the transformation of our sector would give a great boost to these first steps and would accelerate the decarbonisation of all sectors that rely on - or may benefit from - the transition of our industry.

In particular, for the aviation sector, the following regulatory actions should be taken for an accelerated SAF uptake:

- Enable predictable growth: allow annual national SAF incentives to anticipate ReFuelEU targets, and define post-2030 annual mandates in the 2027 ReFuelEU revision.

- Provide feedstock certainty: clarify rules for new feedstocks like intermediate and degraded land crops, and avoid overregulation that discourages their adoption.

- Recognise co-processed RFNBO hydrogen contributions in final products: RED and ReFuelEU Aviation must acknowledge a RFNBO share when it is chemically bound or enhances the heating value of the SAF.

- Improve SAF regulatory conditions: advance clear rules for Low-Carbon Fuels and align circular carbon sourcing criteria across RED and ETS systems.

The aviation industry needs sustainable fuels. Europe’s fuel manufacturers are already delivering and are ready to accelerate.

Our industry has always supported the EU's climate goals and actively contributes to their achievement, being one of the key sectors for the successful transition to climate neutrality. However, the challenges it faces concerning competitiveness and the investment environment within the EU require collaboration and alignment among all stakeholders, fostering open and unbiased discussions with policymakers, and leveraging all strategic industrial and production sectors of the EU.

We are here—ready to contribute to the major challenges and goals ahead. We call for recognition of our strategic role in shaping a future of sustainable transport—on land, in the air, and at sea.

BCG sustainable aviation needs a faster takeoff - March 27, 2025.

EASA – State of the EU SAF March 2023.

2021-2023 data rely on Argus Media average SAF prices, referenced in EASA – State of the EU SAF Market 2023 2024 data is an indicative industry estimate based on SAF market tracking.